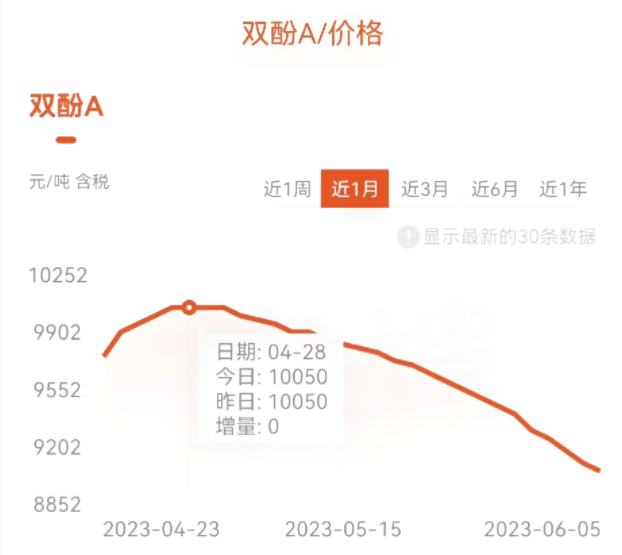

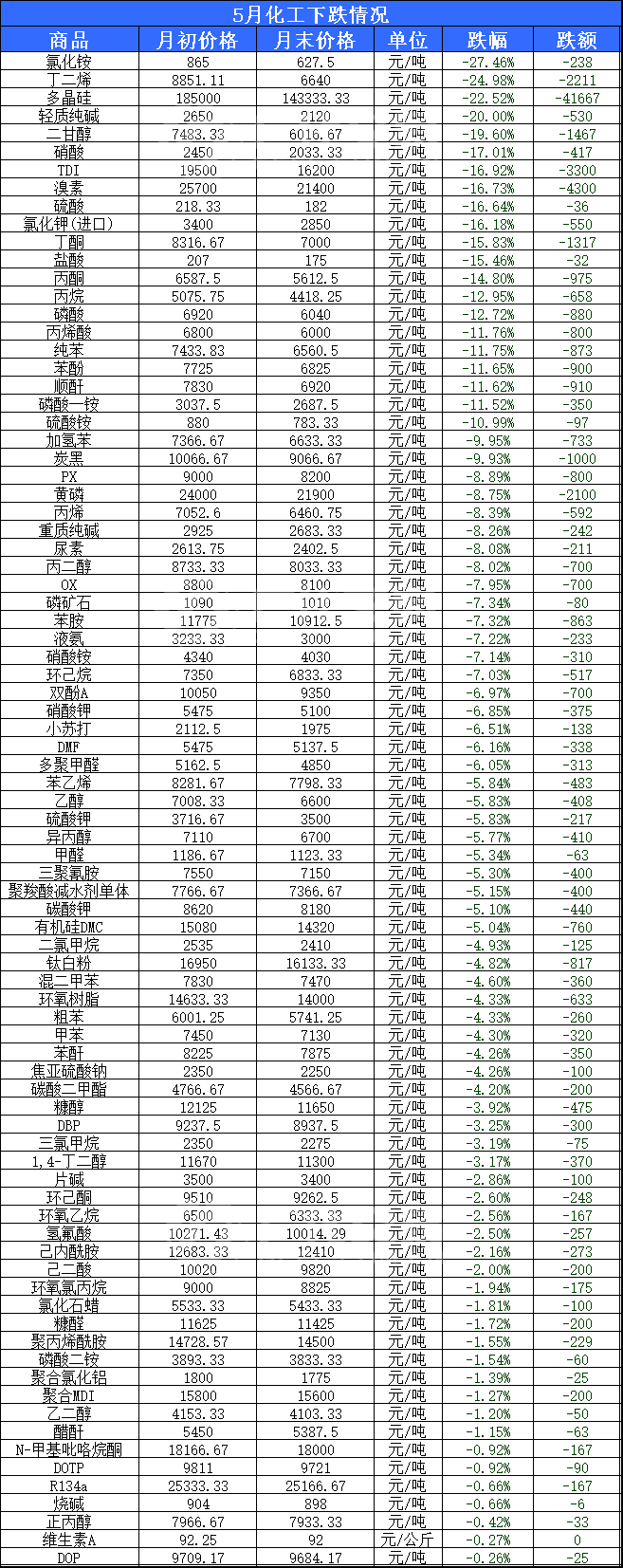

Од мај, побарувачката за хемиски производи на пазарот е под очекувањата, а периодичната контрадикција помеѓу понудата и побарувачката на пазарот стана изразена. Под трансмисијата на вредносниот синџир, цените на бисфенол А во индустриите со висок и низводен тек колективно се намалија. Со слабеењето на цените, стапката на искористеност на индустрискиот капацитет се намали, а намалувањето на профитот стана главен тренд за повеќето производи. Цената на бисфенол А продолжи да опаѓа, а неодамна падна под границата од 9000 јуани! Од трендот на цените на бисфенол А на сликата подолу, може да се види дека цената се намалила од 10050 јуани/тон на крајот на април на сегашните 8800 јуани/тон, што е намалување од 12,52% на годишно ниво.

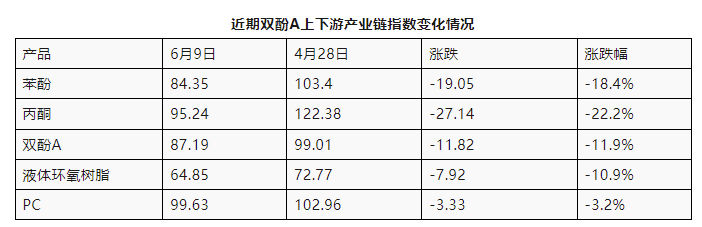

Сериозен пад на индексот на индустриските синџири нагоре и надолу по течението

Од мај 2023 година, индексот на индустријата за фенолни кетони се намали од максимум 103,65 поени на 92,44 поени, што претставува намалување од 11,21 поен, или 10,82%. Трендот на опаѓање на индустрискиот синџир за бисфенол А покажа тренд од голем кон мал. Индексот на единечен производ на фенол и ацетон покажа најголем пад, од 18,4% и 22,2%, соодветно. Бисфенол А и течната епоксидна смола од низводно производство го зазедоа второто место, додека PC покажа најмал пад. Производот е на крајот од индустрискиот синџир, со мало влијание од нагорниот тек, а крајните индустрии од низводно производство се широко распространети. На пазарот сè уште му е потребна поддршка и сè уште покажува силен отпор кон пад врз основа на производствениот капацитет и растот на производството во првата половина од годината.

Континуирано ослободување на производствен капацитет на бисфенол А и акумулација на ризици

Од почетокот на оваа година, производствениот капацитет на бисфенол А продолжи да се зголемува, при што две компании додадоа вкупно 440.000 тони годишен производствен капацитет. Засегнат од ова, вкупниот годишен производствен капацитет на бисфенол А во Кина достигна 4,265 милиони тони, со годишен пораст од околу 55%. Просечното месечно производство е 288.000 тони, што е нов историски максимум.

Во иднина, проширувањето на производството на бисфенол А не запира и се очекува дека повеќе од 1,2 милиони тони нов производствен капацитет за бисфенол А ќе бидат пуштени во употреба оваа година. Доколку сите се стават во производство според распоредот, годишниот производствен капацитет на бисфенол А во Кина ќе се прошири на околу 5,5 милиони тони, што претставува зголемување од 45% на годишно ниво, а ризикот од континуиран пад на цените продолжува да се акумулира.

Идни перспективи: Во средината и крајот на јуни, индустриите за фенол кетон и бисфенол А продолжија и рестартираа со уредите за одржување, а циркулацијата на стоки на спот пазарот покажа тренд на зголемување. Со оглед на моменталната состојба на стоки, трошоците и понудата и побарувачката, операцијата на дно на пазарот продолжи во јуни, а се очекуваше стапката на искористеност на капацитетите на индустријата да се зголеми; Индустријата за епоксидни смоли низводно повторно влезе во циклус на намалување на производството, оптоварувањето и залихите. Во моментов, двојните суровини достигнаа релативно ниско ниво, а покрај тоа, индустријата падна на ниско ниво на загуби и оптоварување. Се очекува пазарот да го достигне дното овој месец; Под ограничувањата на бавната потрошувачка средина на терминалот и влијанието на традиционалните пазарни услови вон сезона, заедно со неодамнешното продолжување на две производствени линии за паркирање, спот понудата може да се зголеми. Под играта помеѓу понудата и побарувачката и трошоците, пазарот сè уште има можност за понатамошен пад.

Зошто е тешко пазарот на суровини да се подобри оваа година?

Главната причина е што побарувачката секогаш тешко може да го следи темпото на раст на производствениот капацитет, што резултира со прекумерен капацитет како норма.

„Извештајот за предупредување за капацитетот на клучните петрохемиски производи за 2023 година“, објавен од Федерацијата за петрохемиски производи оваа година, уште еднаш посочи дека целата индустрија е сè уште во врвен период на инвестиции во капацитети, а притисокот од противречностите помеѓу понудата и побарувачката за некои производи е сè уште значаен.

Хемиската индустрија на Кина е сè уште на средниот и долниот крај од меѓународниот индустриски синџир на поделба на трудот и синџирот на вредности, а некои стари и постојани болести и нови проблеми сè уште го попречуваат развојот на индустријата, што доведува до ниски можности за гарантирање на безбедноста во некои области од индустрискиот синџир.

Во споредба со претходните години, значењето на предупредувањето издадено во овогодинешниот Извештај лежи во сложеноста на моменталната меѓународна ситуација и зголемувањето на домашните неизвесности. Затоа, прашањето за структурниот суфицит оваа година не може да се игнорира.

Време на објавување: 12 јуни 2023 година